Every year, the IRS makes cost-of-living adjustments that affect contribution limits for retirement plans and set thresholds for tax deductions, exclusions, and exemptions. Here are the key adjustments for 2019:

Employer retirement plans

- Employees in 401(k), 403(b), and most 457 plans can defer up to $19,000 of their compensation in 2019 (up from $18,500 in 2018). Those age 50 and older can defer up to an additional $6,000 in 2019 (the same as last year).

- Employees in a SIMPLE retirement plan can defer up to $13,000 in 2019 (up from $12,500 in 2018), and those older than 50 can defer up to an additional $3,000 in 2019 (the same as in 2018).

IRAs

The annual limit on contributions to traditional and Roth IRAs increased to $6,000 in 2019 (up from $5,500 in 2018), and people older than 50 can contribute an additional $1,000. That can be contributed to one or both, but cannot exceed those limits.

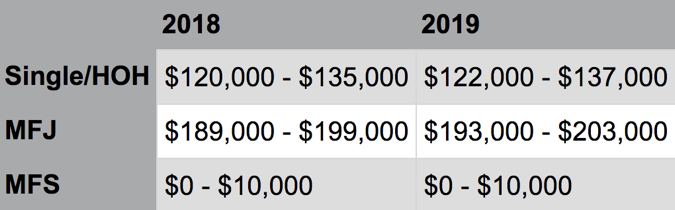

For people covered by a workplace retirement plan, the deduction for contributions to a traditional IRA is phased out for the following modified adjusted gross income (AGI) ranges:

Note that the 2019 phaseout range is $193,000 – $203,000 (up from $189,000 – $199,000 in 2018) when the person making the IRA contribution is not covered by a workplace retirement plan but is filing jointly with a spouse who is covered.

Roth IRAs

The threshold ranges of modified AGI phaseout ranges for individuals to make contributions to a Roth IRA are:

Gift taxes

The annual gift tax exclusion for 2019 remains $15,000 per person, the same as in 2018. The amount not subject to gift and estate taxes (the basic exclusion amount) for 2019 rose to $11.4 million, up from $11.18 million in 2018.

Kiddie tax

Under the kiddie tax rules, unearned income above $2,200 in 2019 (up from $2,100 in 2018) is taxed using the trust and estate income tax brackets. The kiddie tax rules apply to: (1) those under age 18, (2) those age 18 whose earned income doesn’t exceed one-half of their support, and (3) those age 19 – 23 who are full-time students and whose earned income doesn’t exceed half of their support.

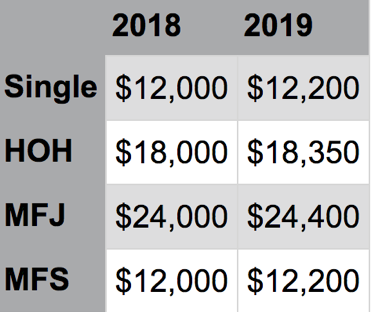

Standard tax deductions

And finally, new AMT levels: