Investing to Outpace Inflation

One of the reasons we invest in markets is to protect our money from the corrosive impact of inflation. When prices increase over time, the earning power of a dollar is reduced.

That’s what inflation is: the erosion of the real purchasing power of wealth. Inflation is an important aspect of investing. In many cases, the reason for saving today is to support future spending. So, keeping pace with inflation is a crucial goal.

investing for the long term

As the value of money declines over time because of increasing prices for goods and services, investing can help grow wealth and preserve purchasing power. Over longer time periods, stocks have historically outpaced inflation, but of course there have also been short-term stretches where this has not been the case. For example, during the 17-year period from 1966–1982, the S&P 500 Index gained 6.8% before inflation, but after adjusting for inflation the gain was actually 0%. If we look at 2000–2009, the “lost decade,” the return of the S&P 500 Index was down 0.9% before inflation and down even more after inflation: negative 3.4%.

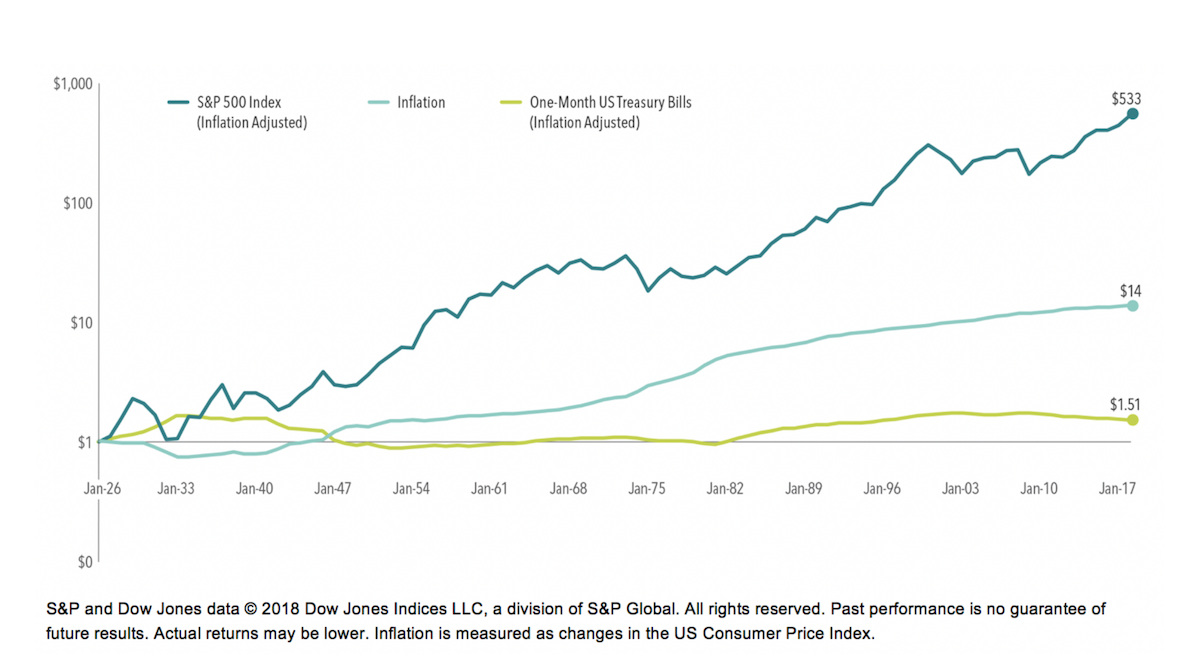

Despite some periods where stocks have failed to outpace inflation, one dollar invested in the S&P 500 Index in 1926, after accounting for inflation, would have grown to more than $500 of purchasing power at the end of 2017 and would have significantly outpaced inflation over the long run. The story for US Treasury bills (T-bills), however, is quite different. In many periods, T-bills were unable to keep pace with inflation, and an investor would have experienced an erosion of purchasing power. After adjusting for inflation, one dollar invested in T-bills in 1926 would have grown to only $1.51 at the end of 2017.

growth of $1, from 1926-2017

As the chart shows, while stocks are more volatile than T-bills, they are also more likely to outpace inflation over long periods. The lesson here is that volatility is not the only type of risk that should be of concern. Many need to have some of their portfolio’s allocation in growth investments that outpace inflation to maintain their standard of living and grow their wealth.

TIPS: Treasury Inflation-Protected Securities

One additional tool available to investors who are concerned about both stock market volatility and inflation are Treasury Inflation-Protected Securities (TIPS), according to Dimensional Fund Advisors and Capital Group. TIPS are guaranteed by the US Treasury and as such are considered by the marketplace to have low risk of default.

The Treasury issues TIPS with a variety of maturities, and these securities are easily bought and sold. TIPS have been flat for several years, but with a surge in inflation, they can support a portfolio. Unlike traditional Treasury securities such as T-bills, TIPS are indexed to inflation to protect investors from an erosion in purchasing power. As inflation (measured by the consumer price index) rises, so does the par value of TIPS, while the interest rate remains fixed. This means that if inflation unexpectedly rises, the purchasing power of any principal invested in TIPS should also increase. Although they likely do not offer the long-term growth opportunities that stocks do, their structure makes TIPS an effective risk management tool for those concerned with managing uncertainty around future purchasing power.

Market prices incorporate market participants’ expectations about the future. Therefore, market participants’ expectations about future inflation should be incorporated into current prices. These expectations are referred to as expected inflation. Unexpected inflation refers to unexpected changes in inflation that deviate from prior market expectations. Unexpected inflation should be considered a primary driver of inflation risk.

By combining the right mix of growth and risk management assets, we can blunt the effects of inflation and grow wealth over time. Remember, however, that inflation is only one consideration among many that investors must contend with when building a portfolio for the future. The right mix of assets for you depends on your unique goals and needs.