You can always count on market swings to challenge your patience as an investor, but these current swings – and the reasons for them – are unprecedented in their speed and depth.

Tune Out the Noise

The media generates news 24 hours a day, seven days a week, and they need to fill all that time. You can check the market and access the news any time and anywhere, and it can be addicting, especially now. This barrage of information might make you feel that you should buy or sell investments in response to the latest news, whether it’s an unexpected pandemic, a large market drop, or a geopolitical event. This is a natural response, but studies show that it’s not wise to react emotionally to market swings or to news that you think might affect the market. We do make changes during times of market stress, of course, but we follow your financial plan and do not react to news with emotion.

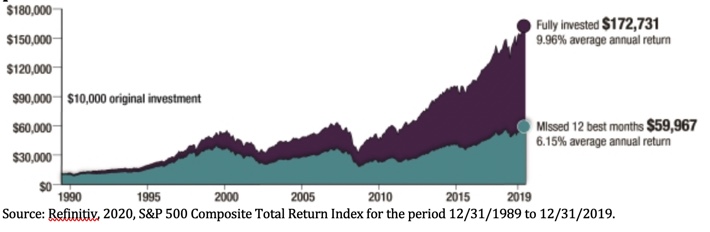

“Time in the market” is generally more effective than trying to “time the market.” An investor who remained fully invested in the U.S. stock market over the past 30 years would have received almost triple the return of an investor who missed only the market’s best 12 months. That’s the difference between the gains below.

The markets are volatile and will continue to be. Here’s an illustration about the pitfalls of reacting to economic news: those investors who were spooked on recession fears sparked by an inverted yield curve who sold on August 14, missed out on more than 13% equity market growth during the rest of the year. A yield curve inversion has been a predictor of past recessions, and event rocked the stock market last summer, but despite the headlines, a yield curve inversion is not a guarantee to be an immediate precursor to a recession.

Wise Words

Consider this advice from John Bogle, mutual fund industry pioneer: “Regardless of what happens to the markets, stick to your investment program. Changing your strategy at the wrong time can be the single-most-devastating mistake you can make as an investor.”

This doesn’t mean we don’t buy or sell investments during a crisis, but the moves we make are based on your financial plan, on a sound strategy appropriate for your financial goals and time frame, as well as your capacity and tolerance for risk. A sound investment strategy should carry you through market ups and downs over time. Your portfolio should foremost protect your spending needs in the near-term, so you don’t have to be a forced seller in a down market.

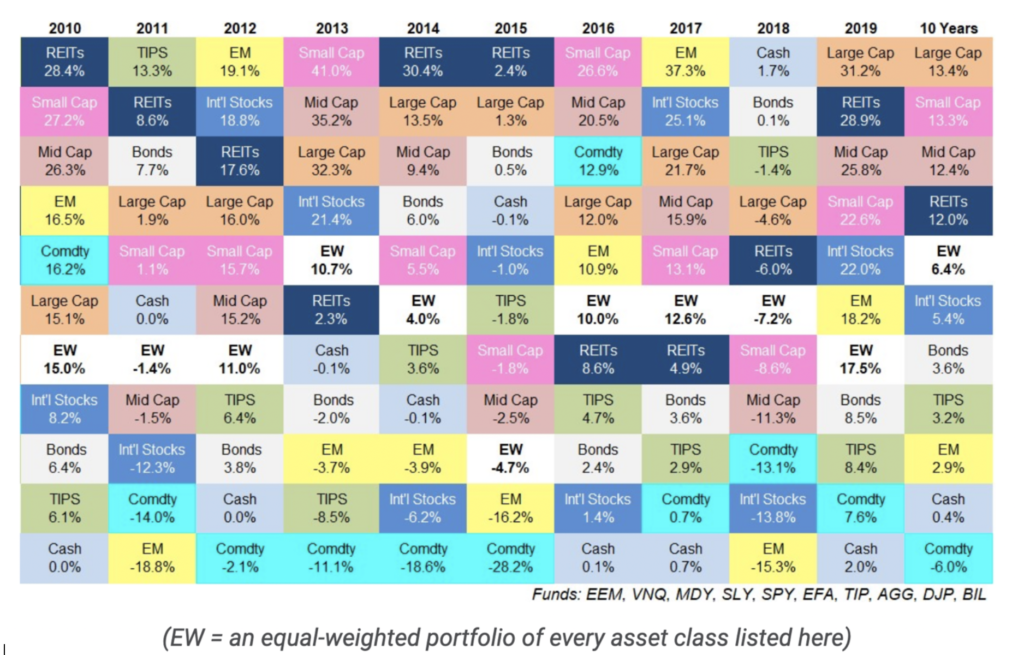

It can be hard to keep cool when you see the market dropping or to control your exuberance when you see it shooting upward. The Returns Quilt below shows the returns of different asset classes over the last 10 years, and each year a different asset class comes in first. But trying to “time the market” by guessing at future direction of those asset classes may create additional risk that could negatively affect your long-term portfolio performance.

And remember the wisdom of Warren Buffet,”Be greedy when others are fearful, and be fearful when others are greedy.”