What Will You Pay for Medicare in 2019?

Medicare premiums, deductibles, and coinsurance amounts change annually. Here’s a look at some of the costs for 2019 for those enrolled in Original Medicare (Part A and Part B).

Medicare Part B premiums

Most with Medicare who receive Social Security benefits will pay the standard monthly Part B premium of $135.50 in 2019. However, for some whose premiums are deducted from Social Security benefits and the 2019 increase in benefits will not be enough to cover the Medicare Part B increase, then they may pay less than the standard Part B premium, according to the Centers for Medicare & Medicaid Services.

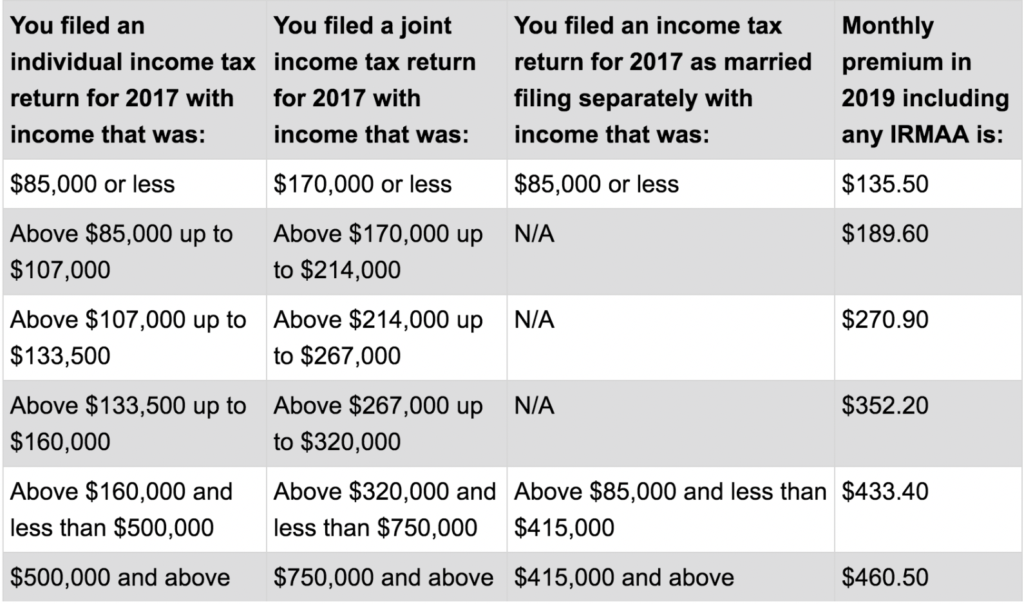

Those with higher incomes may pay more than the standard premium. If your modified adjusted gross income as reported on your federal income tax return from two years ago is above a certain amount, you’ll pay the standard premium amount plus an “Income Related Monthly Adjustment Amount,” or IRMAA, which is an extra charge added to your premium, as shown in this table:

Other Medicare costs

Other Medicare Part A and Part B costs in 2019:

- The annual Medicare Part B deductible for “Original Medicare” is $185.

- The monthly Medicare Part A premium — for those who need to buy coverage — will cost up to $437. However, most people don’t have to pay a premium for Medicare Part A.

- The Medicare Part A deductible for inpatient hospitalization is $1,364 per benefit period. An additional daily co-insurance amount of $341 will apply for days 61 through 90, and $682 for stays beyond 90 days.

- Beneficiaries in skilled nursing facilities will pay a daily co-insurance amount of $170.50 for days 21-100 in a benefit period.