Among your most important financial friends is diversification. After all, what other single action can you take to simultaneously dampen your exposure to a number of investment risks while potentially improving your overall expected returns? While “diversification” may seem like a buzzword, the benefits of diversification are well-documented and explained by some 60 years of academic inquiry. Its powers are robust.

Global Diversification

What is diversification? In a general sense, it’s about spreading your risks around. More detailed, it means more than just ensuring you have many holdings, it’s also about having many different kinds of holdings. If we compare this to the old adage about not putting all your eggs in one basket, a good comparison would be to ensure that your baskets contain not only eggs but also fruits, vegetables, grains, meats and cheese.

While this may make intuitive sense, many people come to us thinking their portfolios and work retirement accounts are well diversified when they are not. They may own a large number of stocks or stock funds across numerous accounts. But with closer analysis, we find that the bulk of their holdings are concentrated in large-company U.S. stocks. This would have been a home run in 2014, but it does not carry the safety of spreading your assets over many categories.

A concentrated portfolio is the undiversified equivalent of a basket full of plain white eggs. Over-exposure to what should be only one ingredient among many in your financial diet is not only unappetizing, it can be detrimental to your financial health. Lack of diversification:

- Increases your vulnerability to specific, avoidable risks

- Creates a bumpier, less reliable overall investment experience

- Makes you more susceptible to second-guessing your investment decisions

Combined, these three strikes tend to generate unnecessary costs, lowered expected returns and, perhaps most important of all, increased anxiety. You’re trying to beat a powerful market.

It’s All About What You Take Home

To best capture the full benefits that global diversification has to offer, we turn to the sorts of fund managers who focus their energies – and yours – on efficiently capturing diversified factors of global returns, unhampered by unnecessary efforts, extraneous costs and irritating distractions to your resolve as a long-term investor. Research has proven that diversification alone can help you have your cake and eggs and everything necessary for a full meal. In fact, Harry Markowitz, Nobel Prize winning economist, calls diversification the only “free lunch” when it comes to investing.

A World of Opportunities

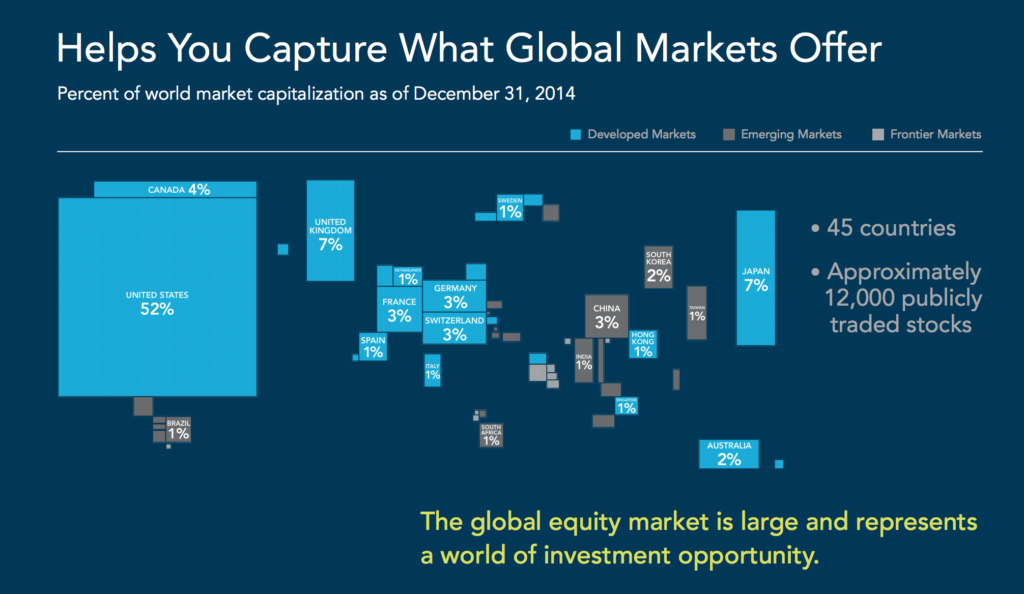

We consider a wide world of investment opportunities available these days from tightly managed mutual funds intentionally designed to facilitate meaningful diversification. They offer efficient, low-cost exposure to capital markets found all around the globe.

Source: Dimensional Fund Advisors