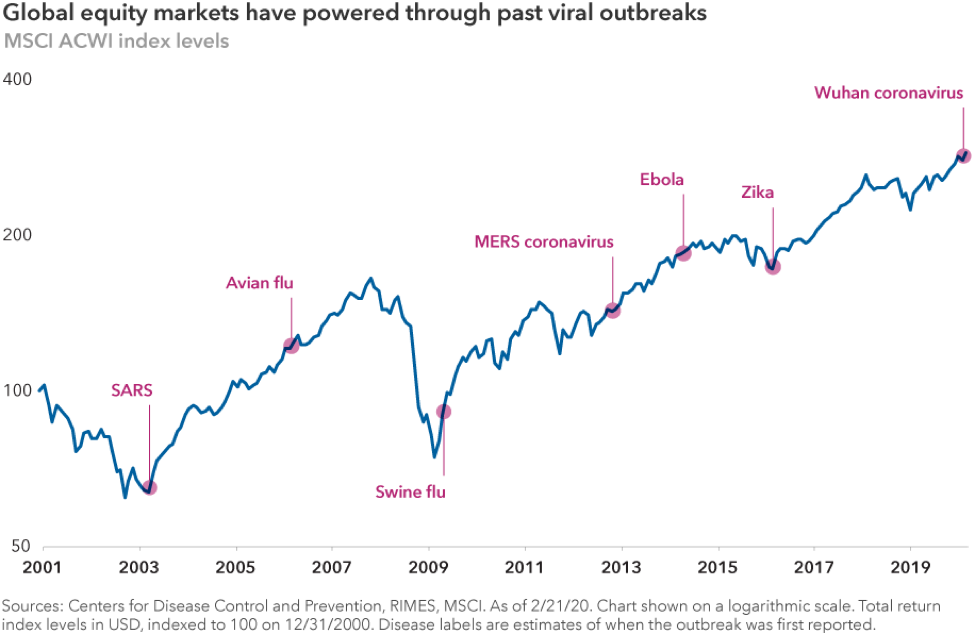

Chart thanks to Capital Group.

We don’t know how bad this is going to be. That’s the scary part. We can wash our hands, wear masks, talk about morbidity percentages, but the extent of the coronavirus – and its impact on the markets – is unknown.

So what to do? We can look at the historical context of previous plagues and pandemics and viruses and their impact. It does help ease our minds to look at the history of pandemics on the global markets, as shown in this chart:

The virus is indeed taking its toll on business across the world, and the markets are reflecting some of that fear. Starbucks closed roughly half of its 4,300 stores in China. Many U.S.-based airlines have canceled flights to the country and others impacted by the virus. Some companies are lowering earnings guidance for 2020, including some of the world’s biggest cruise line operators and consumer-goods makers. Many sporting events and international conferences in the U.S. and elsewhere have been cancelled through the summer as fear of the virus spreads.

However, the coronavirus is also giving a boost to some companies – things you can do inside, like e-commerce, gaming, home entertainment. This is the case for Chinese technology giant Tencent, which operates one of the world’s largest mobile video game and social media platforms.

We are waiting and watching, and washing our hands. We offer video conferences for clients who want to avoid the potential for community spread.

And remember, the markets are influenced in the short-term by emotions, and in the long-term by the strength of company fundamentals and underlying economies.